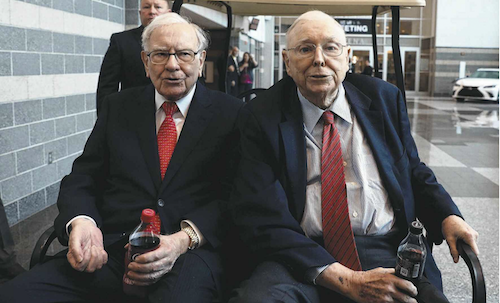

It's official. Charlie Munger, 97 years young, will headline this year's Sohn Hearts & Minds investor conference.

Landing the American billionaire investor, vice-chairman of Berkshire Hathaway and alter ego to Warren Buffett is a coup for the two co-executive chairs at Barrenjoey, Matthew Grounds and Guy Fowler, and veteran fund manager and philanthropist Chris Cuffe. Each one of them is a big player in Australian capital markets and investment. “We finally got our man. I don't think he does these sorts of things anywhere,” Fowler said.

“We'd start off every year saying ‘who could we possibly dream of having at the conference?' We've had Ray Dalio, we've had Howard Marks, Scott Galloway, all brilliant, but every year we sit there and say ‘is there a chance, is there any way we could possibly get someone from Omaha?' ”

The star pick is thanks to Caledonia's Mark Nelson, a long-time supporter of Hearts & Minds who has made many a pilgrimage to the legendary “Woodstock for capitalists” annual meeting of Berkshire Hathaway attended by 40,000 shareholders. Nelson has known Munger for 25 years.

“We've been asking Mark to see if he could do this for five years” Grounds said. “Mark just wanted to prequalify, make sure the right crowds were there, that we had the Opera House,” he joked.

Cuffe added: “I only just found out that Charlie and Mark Nelson are part of a regular breakfast session that a few very-high profile people, much higher than all of us, have regularly.”

Lockdowns have forced a second virtual Hearts & Minds conference this year, which Fowler said was serendipitous because the Opera House seated only 600.

Munger's interview will be an exclusive appointment viewing for attendees, with no replay.

Hearts & Minds, now in its fifth year, is billed as the thinking investor's conference.

It is an idea unashamedly pinched from the philanthropic US Sohn Conference by Grounds, Fowler and businessman Gary Weiss in 2016. The conference is now a partner and raises millions of dollars annually for medical research. It combines keynotes from some of the biggest names in international and Australian investment alongside a string of often fresh talent who each have just 10 minutes to deliver a TEDxstyle pitch on one stock. Many pay to speak and share their IP.

“Probably a third of the list I will never have heard of and I think gee I've hung around this industry forever. The world is a big place for investment management,” Cuffe said.

The conference itself makes about $2m a year, but what is different from Sohn in the US is the listed investment company HM1 created from the conference that now spits out $15m a year for charity.

“Guy had an idea to set up a private fund, which we did when we were at UBS,” Grounds said. “We just did a small fund of $30m$40m wrapped around the stock picks for a year that went really well.”

So well that Grounds and Fowler decided to look at a $100m LIC and approached their old mate Cuffe to chair it.

“Chris said love it, except I won't do it unless it's half a billion dollars. True story,” Grounds said laughing. Sixty-five per cent of the funds under management would come from six core fund managers who would each pick three stocks. Thirty-five per cent would come from the most popular 10minute pitches of the conference.

Fowler took a roadshow to fund managers pitching the idea and came back with a thumbs-up on the high-conviction investment. “There had been some academic work done around a collection of fund managers with their top stock picks doing really well. The proof has been in the pudding at HM1,” he said.

Three years in, HM1 is now about $1bn in size and owns the rights to the conference. Its return to September this year was down a little at 15 per cent but over the past three years Cuffe said it had returned 25 per cent against a benchmark 15 per cent, comfortably beating the index. “Unlike most other LICs in the past couple of years, HM1 has continued to trade at around NTA or a slight premium and on good volumes, so people like it,” Cuffe said.

The fundies waive their fees and HM1 powers donations for medical research with 1.5 per cent of NTA, now $15m a year going to medical research.

So has anyone been to Omaha, Nebraska? “Haven't been to Omaha,” Fowler said.

“Never,” said Cuffe. “It's on the list. I'd better go before the lads get too much older - or before I get too much older.”

All three have no doubt that Munger will captivate investors. If last year's pandemic upended markets, the recovery presents a different challenge for fund managers and stock pickers.

“It's important to sit down and understand the philosophies again from someone who has seen it all,” Fowler said. “He's proven to be one of the greatest and best of all time. He hasn't invested in fads, he's invested where he understands. He calls it the circle of competence.”

Fowler said together Munger and Buffett had stuck to the same formula for 50 years. “They hate cryptocurrencies, think they are an absolute scam. They don't trade, they back a good company and good management team and are happy to be invested there for 30-40 years.” He pointed to Coca-Cola and more recently Apple.

“I've been investing for 30 years or more, but right now there is more of a confluence of issues than I have ever felt, particularly with interest rates so low,” Cuffe said. “I don't see the conference as having a particular theme but certain of the speakers Charlie Munger will listen with interest on what he thinks about investment bargains of the world.”

In Cuffe's experience across Colonial First State, Challenger and UniSuper, long-term investing is a rare skill: “In the last 20 years nearly everybody has this business risk thing at the back of their mind. If they are different from the pack for more than 12 months, they get worried. Good investors are not worried about a time frame like that and that's what sets them apart, they are the super long-term investors.”

Returning to the conference are two stellar stock pickers from last year: Cota Capital's Babak Poushanchi, whose pick Bill.com delivered 179 per cent returns for HM1 investors, and Tekne Capital, whose pick Yeahka clocked up 112 per cent returns.

New speakers announced so far include Eleanor Swanson from Firetrail Investments, Yen Liow from Aravt Global and Jay Kahn from Flight Deck.

When it began, Sohn Hearts & Minds was associated with UBS where both Grounds and Fowler worked. When both left in 2019, later moving to set up rival investment bank Barrenjoey, the conference went with them.

Hearts & Minds has managed to keep the UBS sponsorship. So no hard feelings then?

Both men laugh. “Of course they would be a major sponsor,” Grounds said. “Goldmans like it. There are plenty of people there who love the conference, it's universal across the market.”

The 2021 Sohn Hearts & Minds Conference will be held on December 3. Tickets and details at sohnheartsandminds.com.au

This article was originally posted by The Australian here.

Licensed by Copyright Agency. You must not copy this work without permission.