Hi everyone

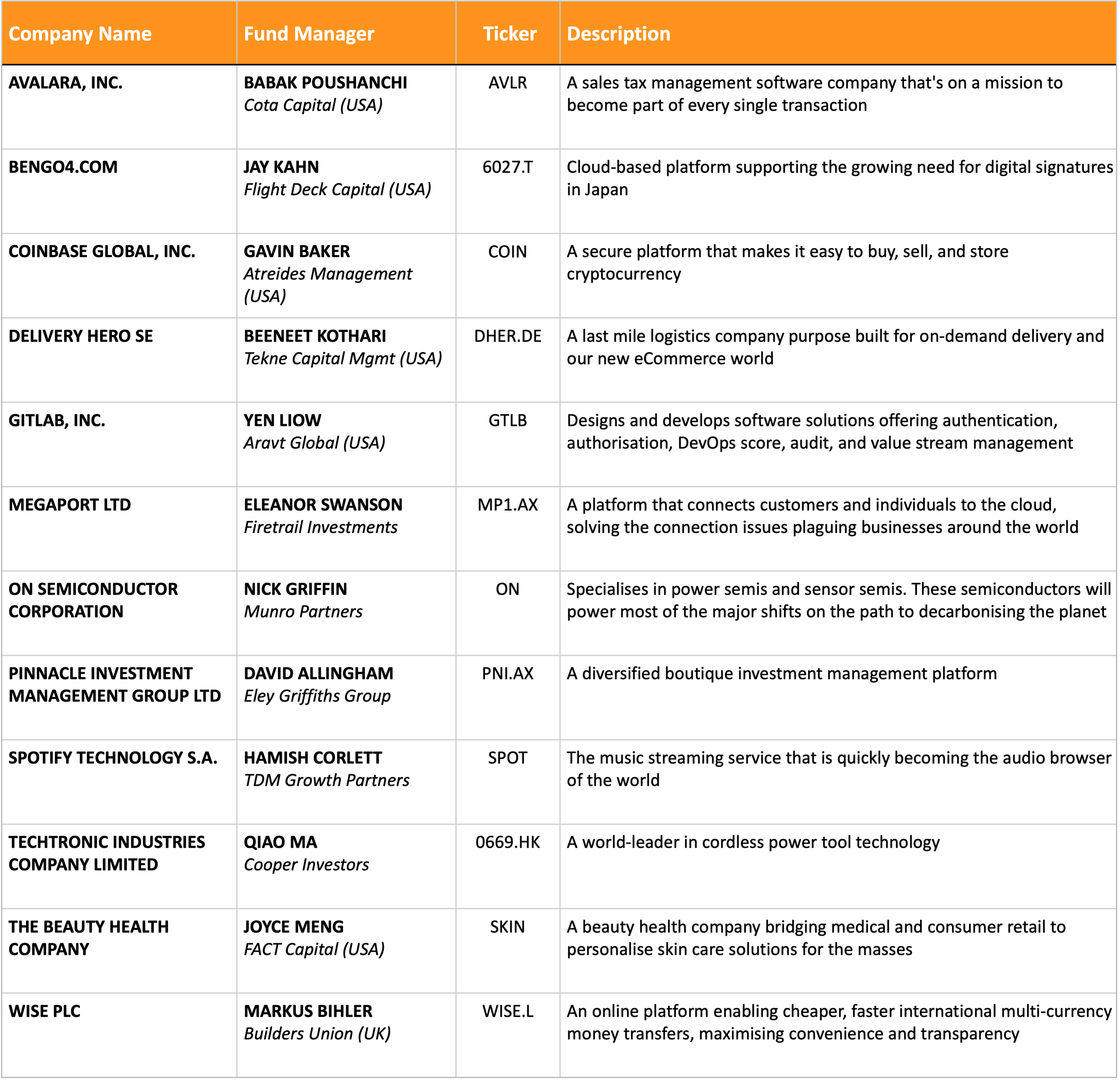

For those of you who viewed the sixth Sohn Hearts & Minds Investment Leaders Conference ten days ago, I’m sure you’ll agree that the speaker line-up was simply amazing. It was a privilege to hear the insights of 97-year-old investment legend Charlie Munger from Berkshire Hathaway, especially what he had to say on Costco, China-US relations, (pharma) regulation, and crypto markets; Professor Robert Langer (co-founder of Moderna) talk about vaccines and share his thoughts on Omicron; and of course, the 13 individual stock presentations (see list below).

Perhaps more than ever before, our speakers delivered a suite of companies that most will not have even heard of, yet what each of them do is already an integral part of everyone’s day to day lives. We learnt about companies like Avalara, which provides solutions to complex sales tax calculations, and is on a mission to become a part of nearly ‘every transaction that takes place in the world’. There was Delivery Hero, which focuses on “last mile logistics” as Beeneet describes it, and is purpose build for on-demand delivery and our new eCommerce world. Nick Griffin told us about how semi-conductors are like the Arc reactor in the Iron Man suit, a hidden hero… an integral part of every piece of technology we use daily. He explained just how big it’s likely to become, especially with the advent of next generation electric cars, which we all know is coming.

Megaport, listed here in Australia, connects companies and individuals to each other via the cloud, while WISE in London allows for a far smoother (and cheaper) experience with cross border payments, which are increasing rapidly with the rise of the ‘Global Young Consumer’ generation as Markus described them. Newcomer Jay Kahn from Flight Deck Capital pitched what he described as the “DocuSign of Japan”, and we all got to see how DocuSign has grown since Babak pitched it three years ago.

2021 wouldn’t be complete without some mention of cryptocurrencies, and so Gavin told us about Coinbase, a crypto marketplace that looks set to gain from increasing acceptance and use of various cryptocurrencies. Such is the conviction that Hamish Corlett has in Spotify, which everyone has heard of, and most use daily, that he gave us a refreshed pitch from his already successful 2019 version, explaining why Spotify is well on its way to being the ‘audio browser of the world’.

To have one asset manager pitch a different asset manager was another first, and I’m sure you’ll agree that David’s explanation of Pinnacle (listed locally as well) has opened the eyes of many listeners looking for a diversified investment alternative. Newcomer Joyce Meng showed us that beauty and skincare is indeed a viable investment opportunity, and again a part of everyone’s everyday lives, just like Qiao did with her energetic pitch on power tools, sharing how they have become more technological than industrial, and Yen Liow told us about why he thinks Gitlab may just be the next Atlassian.

Over summer, I’ll write more on the companies that were presented this year, as so much of the disruptive technology we are seeing is becoming increasingly embedded into our lives.

Summary of the 2021 Conference Portfolio

Stay safe,

Rory Lucas

Chief Investment Officer

Hearts and Minds Investments Limited

Reminder: these are simply my general views and should not be taken as investment advice

If you would like to receive these weekly updates direct to your inbox each Monday, sign up here.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.