Hi everyone

First of all, congratulations to Dylan Alcott for being named Australian of the Year for 2022 and to Ash Barty for being, well Ash Barty, who to me epitomises what every young person should aspire to be: honest, hardworking, respectful of others, and simply nice! Good luck in the rest of your Australian Open campaign Ash – go you good thing!

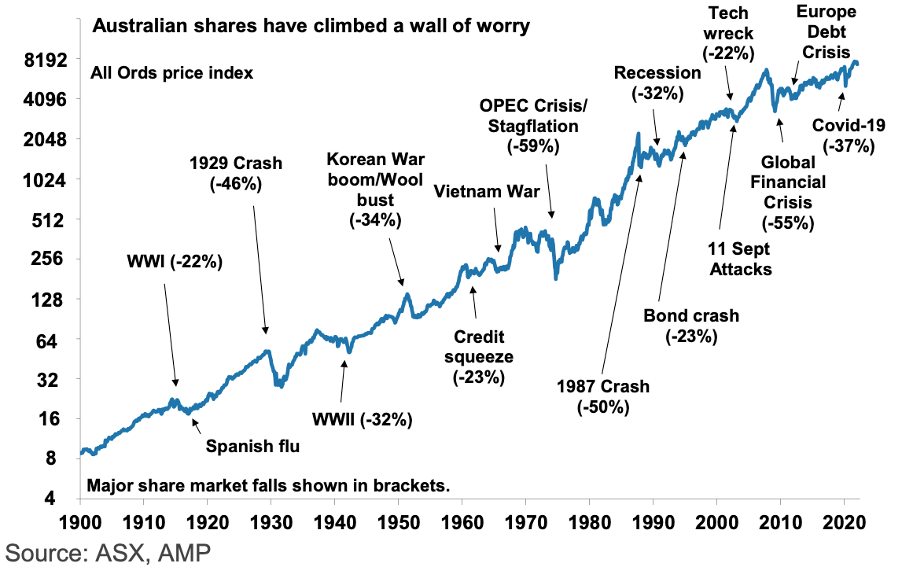

In thinking what to write about this week, I came across the chart below which perhaps says it better than I ever could. A picture does show a thousand words they say. It shows the scale of the corrections we have seen over the last 120 years compared to the appreciation in the equity market over that time including what I will call the various (and pretty regular) ‘speed bumps’ experienced. A quick look at the numbers in brackets, which represent each decline, demonstrates that equity investing is volatile, but the market has consistently delivered returns over longer investment timeframes.

With the correction we are currently seeing, I have even more than usual interaction with our managers, seeking their views on how long we can expect this sell-off to continue, whether it’s the start of something much bigger, whether interest rates will be dramatically raised (we all know they have to go up from the near zero level we’ve had for the last few years), and whether their conviction in the stocks we hold has changed in the new investment landscape we find ourselves in.

What I’m going to talk about now pertains to our core portfolio which represents 65% of our invested capital, rather than our conference portfolio.

The investment thesis of a core portfolio holding will generally be 5+ years, meaning that our managers believe excess returns will be generated by holding the companies over a longer time period. Our managers expect that these companies will have occasional bad quarters, or that the management team will make some mistakes along the way, but also that these ‘blips’ should not have a substantial impact on longer term earnings which, at the end of the day, are the true drivers of share price returns. Our managers are rigorously analysing our companies’ long term earnings forecasts in light of the shorter-term news being reported by the media right now.

Like I said last week, we do not know how much inflation will persist over the next five years; we don’t know how far interest rates will be raised, especially with unemployment sitting at historic low levels. One of our managers described share prices like this: “…there is no saying how portfolio companies are valued. Instead, each stock is valued every day by myriad market participants, including some who are reacting to the latest social media posts. The current share price reflects all their emotions, cognitive biases, fears and dreams…. Stocks also get bid up on waves of euphoria…. we think stocks rarely spend time at fair value…. this can be vexing at times.”

Another of our managers told me, “The investment case is a 5-10 year story and not a 3-6 month story which will always react to short term … numbers…. The … adds in 2021 were pretty much in line with our long-term expectations and pricing was also in line. The industry is still in the shake out phase and we are confident in the company’s competitive positioning and longer-term economics.”

Right now, we are in the middle of what feels like a really big speed bump in equity markets. The media love reporting how many billions of dollars were wiped off the market on a particular ‘bad’ day. Rarely do they report how much was added on the ‘good’ days, but that’s the media for you. The Hearts and Minds Investments portfolio is a global equity portfolio and is not immune to equity markets sell-offs. The NASDAQ at one stage was down nearly 20% for the month of January alone. On January 3 of this year, the S&P 500 hit an all-time high. Our portfolio has been hit as we have shown with the declines we have reported in our Net Tangible Asset value each week. Hopefully, as the chart at the beginning shows, we will get over this bump and quality companies will resume their expected trajectories.With the correction we are currently seeing, I have even more than usual interaction with our managers, seeking their views on how long we can expect this sell-off to continue, whether it’s the start of something much bigger, whether interest rates will be dramatically raised (we all know they have to go up from the near zero level we’ve had for the last few years), and whether their conviction in the stocks we hold has changed in the new investment landscape we find ourselves in.

What I’m going to talk about now pertains to our core portfolio which represents 65% of our invested capital, rather than our conference portfolio.

The investment thesis of a core portfolio holding will generally be 5+ years, meaning that our managers believe excess returns will be generated by holding the companies over a longer time period. Our managers expect that these companies will have occasional bad quarters, or that the management team will make some mistakes along the way, but also that these ‘blips’ should not have a substantial impact on longer term earnings which, at the end of the day, are the true drivers of share price returns. Our managers are rigorously analysing our companies’ long term earnings forecasts in light of the shorter-term news being reported by the media right now.

Like I said last week, we do not know how much inflation will persist over the next five years; we don’t know how far interest rates will be raised, especially with unemployment sitting at historic low levels. One of our managers described share prices like this: “…there is no saying how portfolio companies are valued. Instead, each stock is valued every day by myriad market participants, including some who are reacting to the latest social media posts. The current share price reflects all their emotions, cognitive biases, fears and dreams…. Stocks also get bid up on waves of euphoria…. we think stocks rarely spend time at fair value…. this can be vexing at times.”

Another of our managers told me, “The investment case is a 5-10 year story and not a 3-6 month story which will always react to short term … numbers…. The … adds in 2021 were pretty much in line with our long-term expectations and pricing was also in line. The industry is still in the shake out phase and we are confident in the company’s competitive positioning and longer-term economics.”

Right now, we are in the middle of what feels like a really big speed bump in equity markets. The media love reporting how many billions of dollars were wiped off the market on a particular ‘bad’ day. Rarely do they report how much was added on the ‘good’ days, but that’s the media for you. The Hearts and Minds Investments portfolio is a global equity portfolio and is not immune to equity markets sell-offs. The NASDAQ at one stage was down nearly 20% for the month of January alone. On January 3 of this year, the S&P 500 hit an all-time high. Our portfolio has been hit as we have shown with the declines we have reported in our Net Tangible Asset value each week. Hopefully, as the chart at the beginning shows, we will get over this bump and quality companies will resume their expected trajectories.

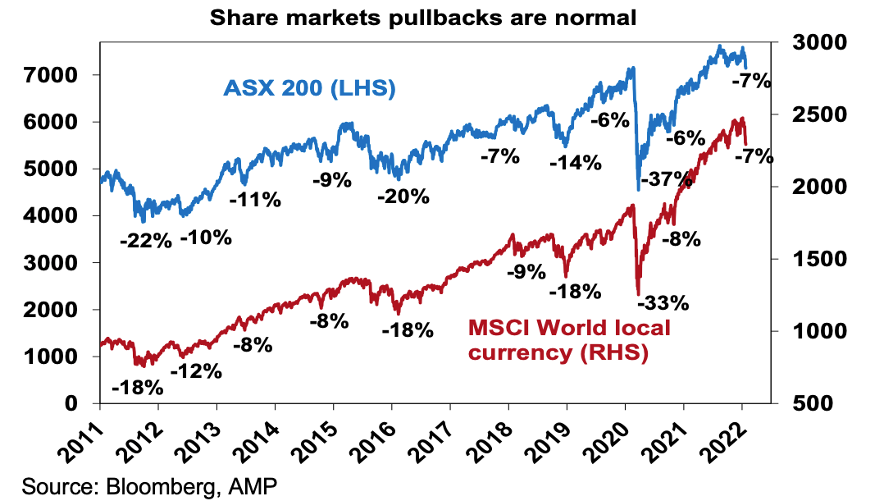

Ps see the second chart below showing the size and frequency of the selloffs in the last 10 years alone.

Stay safe

Rory Lucas

Chief Investment Officer

Hearts and Minds Investments Limited

Reminder: these are simply my general views and should not be taken as investment advice

If you would like to receive these weekly updates direct to your inbox each Monday, sign up here.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.