Hi everyone

First of all, condolences to the family of the man who tragically lost his life on Wednesday in an horrific shark attack at Little Bay in Sydney.

A couple of weeks ago I wrote about the numerous corrections equity markets have seen over the years and how every time eventually the indices have recouped the declines and continued their march higher, which has translated into roughly 9-10% average annual return over the last 120 odd years. The ‘price’ investors pay for this higher return compared to putting your money in the bank, is the volatility of those returns. Some great investors say that they wouldn’t care if markets were to close for 10 years, because the quality businesses they own, (as opposed to a ticker code), will keep generating profits regardless of whether the stock market reports their daily share price. They simply don’t need to see the share price because they view it as if they own a piece of the company.

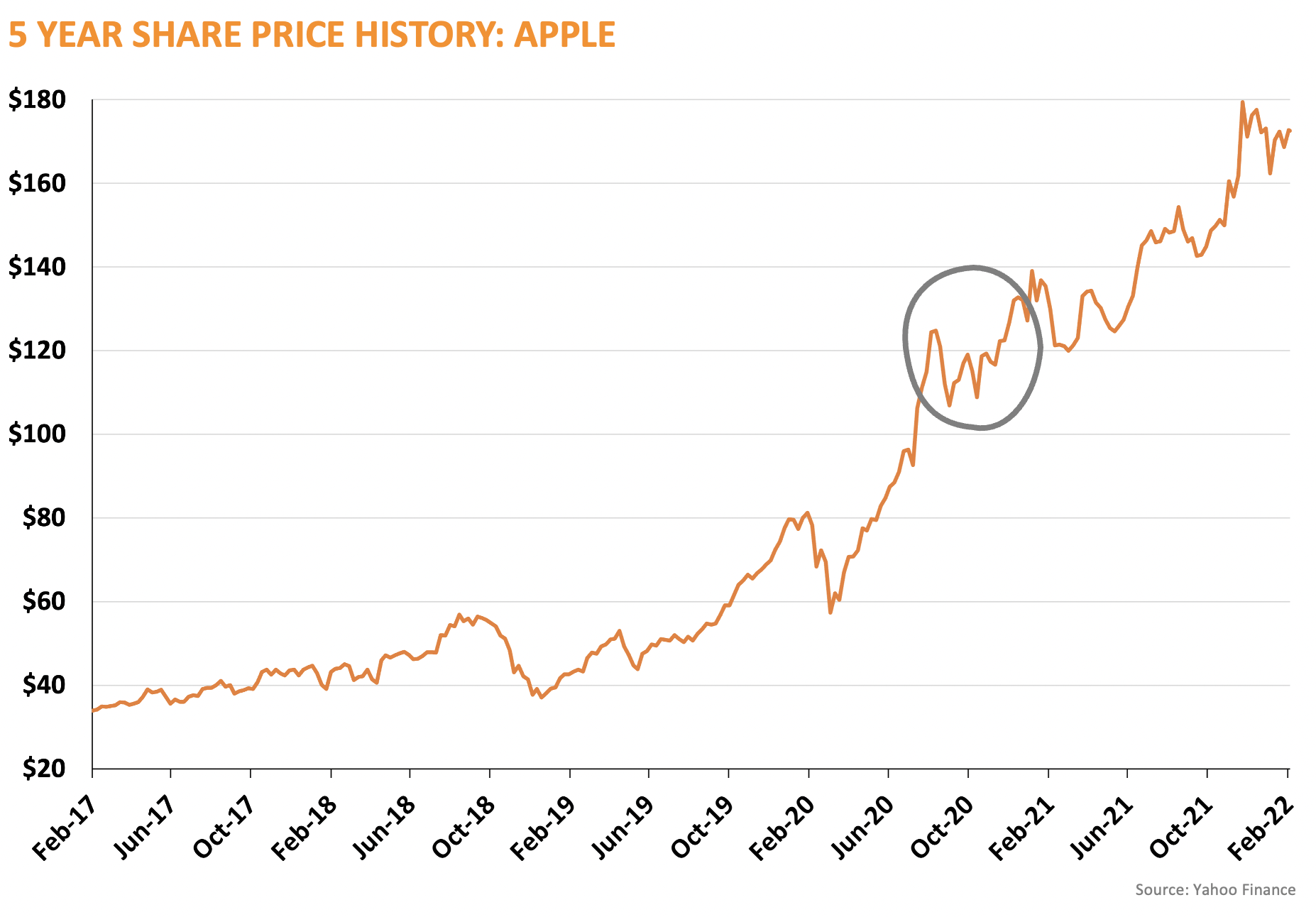

During the US reporting season, I’m sure you all saw the headline when Facebook reported their quarterly earnings: “Facebook share price decline represents the biggest loss of shareholder value in history, at $270mm”. Previously, the biggest shareholder loss was in Apple shares, back in September 2020, at about $180mm ‘lost’. When you look at the chart below, you’ll see that this was merely a ‘speedbump’ in the longer-term share price. My point, other than demonstrating that good investors often ride out the bumps when investing in equities, is that quality companies, just like the broad indices, will always be prone to market corrections, and equally they tend to recover from the declines pretty quickly.

Of course, not all companies will behave like this. Indeed, many companies do eventually collapse, ending up worthless, with investors who are ‘running the marathon’ losing all or most of their capital.

I hear you saying that one minute I’m telling you to run the marathon, but the next minute I’m saying that you could lose everything by doing that. What gives??

Quality. That’s what gives. The cream rises to the top. Bad companies don’t keep making profits through economic cycles, and they get found out. Of course, in the short-term, both good and not-so-good companies can and do have big share price gains AND falls. That’s volatility. That’s the emotional rollercoaster that is the stock market.

Share prices rarely trade at the true, or fundamental value of the company itself. And that’s what makes a market. The skill lies in finding companies that are not trading at their fundamental value, and companies whose value is highly likely to increase over time, because they will dominate their sector, change the way consumers do things, or introduce something altogether new, that competitors cannot readily copy.

Companies, but especially technology companies, often pitch the so called ‘blue sky’ – a promise that 5-10 years down the track, todays spending, or capex (capital expenditure), or re-investment in the business, will eventually pay off. Quality companies deliver on these promises. Remember Amazon in the early 2000’s? No reported profits? I’m sure you all know how the Amazon chart looks over the last 20 years but if you don’t check this out: AMZN 20-year share price low: $15; AMZN 20-year share price high: $3,700!!

Despite the recent share price declines, our managers firmly believe that they have recommended quality companies that are trading below their true value. Many of the company updates over the last 6 weeks or so have confirmed this. However, often we see investors ‘give up’ on companies when the short-term news doesn’t ‘meet analyst expectations’. A sign I love is when management stump up and buy more of their stock when this happens. Indeed, we saw it in one of our companies just last week. Whilst the media seem to love a bloodbath, our managers are always looking for genuine signs that their thesis is intact, or not. This often has very little to do with the daily share price.

Stay safe

Rory Lucas

Chief Investment Officer

Hearts and Minds Investments Limited

Reminder: these are simply my general views and should not be taken as investment advice

If you would like to receive these weekly updates direct to your inbox, sign up here.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.