Hi everyone

What a busy few weeks we’ve had at Hearts and Minds Investments! Apologies to anyone who has missed these missives – hopefully the October monthly kept you updated enough while I’ve had my head down speaking with our fund managers ahead of the conference, and then buying and selling lots of shares.

Two weeks ago, we hosted the seventh annual Sohn Hearts & Minds Investment Leaders Conference in Hobart as a face-to-face event for the first time since 2019. I think I can speak for most attendees (600+) when I say just how well this edition was received – from Andrew Denton stepping in at the last minute to be our Master of Ceremonies, to Mona founder/creator David Walsh telling us his amazing life story, to Bill Browder (famed investor in Russia, author of Red Notice/Freezing Order, creator of the Magnitsky Act, and on Vladimir Putin’s most wanted list) sharing his experiences with the legendary Jennifer Byrne, to Ramez Naam sharing his scientific genius on climate change. TDM Growth Partners' (one of our core managers) Ed Cowan (besides his investment prowess, he is quite the sportsman in his own right) moderated a panel of top private equity investors, who shared their insights on the merits of sport as an investment asset class. Listening to Gerry Cardinale who owns a stake in AC Milan and the Boston Red Sox about investing in sporting teams left the audience fascinated – and of course, more knowledgeable!

And all of that was aside from the 12 stock presentations by our selected fund managers that will now populate 35% of the HM1 portfolio for the next 12 months!

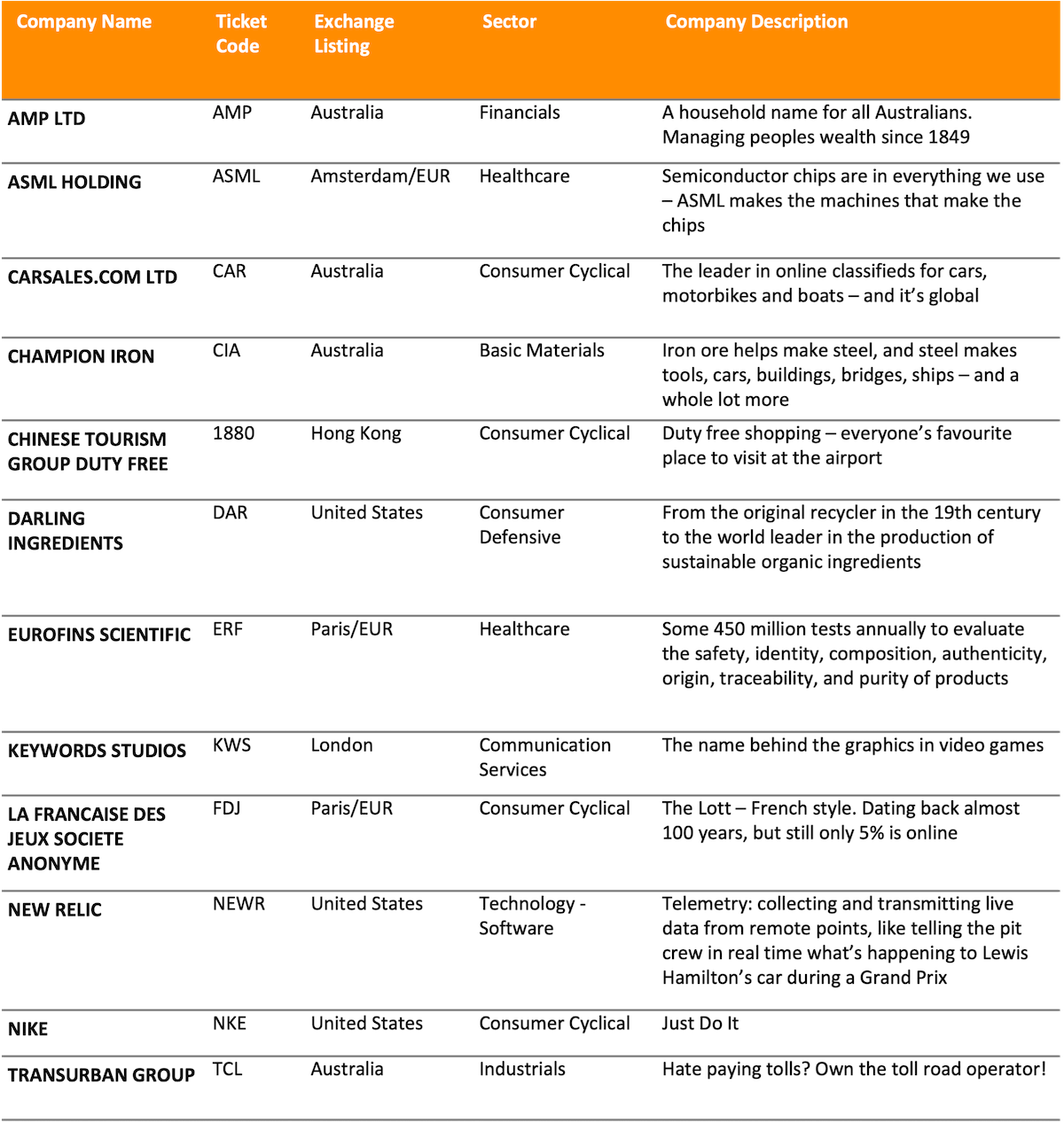

Here are the companies that were pitched to the audience:

As we’ve made clear throughout 2022, the newly formed Fund Manager Selection Committee has worked diligently to deliver a mix of managers and stocks that should perform satisfactorily, regardless of the macroeconomic environment we are faced with. It’s quite the mix of stocks – the leading toll road operator in Australia; one of the most recognisable brands in the world, Nike; one of the oldest names in Australian financial circles, AMP Limited; and the Dutch monopoly business ASML Holdings – the company that makes the machines that make semiconductor chips – and a whole lot of other great businesses. Over the coming months I’ll delve into a few of the companies so that you too become more knowledgeable!

If you read the ASX announcements we release, you will be aware that we made two additional changes recently – the appointment of two new Core Fund Managers; and an amendment to our investment guidelines to permit HM1 to invest in a Core Managers’ Fund, or Individually Managed Account (IMA) where the Board believes that will deliver a better outcome to our shareholders.

The amendment to permit an investment in a Core Fund Manager’s fund was made after reviewing the performance of our Core Fund Managers’ three recommended stocks, compared to the returns of their broader portfolio. Not surprisingly, some have had better returns from their top three recommendations, while others have had better returns with their top 30+ investments. We believe we have experienced fund managers working with us, and this amendment allows for more flexibility in playing to their strengths. This is and will remain an exception rather than a norm, as most of our Core Fund Managers will continue recommending their top three individual investment ideas, just as they have since inception four years ago.

We were also extremely pleased to announce the addition of two new Core Fund Managers, Jun-Bei Liu from Tribeca Investment Partners, and Nick Griffin from Munro Partners.

Nick and Jun-Bei are well known to the HM1 family. Nick has pitched at the last five conferences and has delivered outstanding returns. In Hobart, Nick pitched ASML Holdings - following on from his 2021 pitch thematic of semiconductors, On Semiconductor Corp, which was the top performer from the 2021 conference. Similarly, Jun-Bei has spoken at four of the last five conferences and has also been a stellar performer. Her pitch this year was China Tourism Duty Free – and what a pitch it was!

Obviously the last 12 months have been a very difficult period for all investors. We feel strongly that the addition of Nick and Jun-Bei to the Core Fund Manager grouping will provide HM1 shareholders with a more diverse portfolio of investments, that will deliver satisfactory returns over the next 3-5 years.

Stay safe

Rory Lucas

Chief Investment Officer

Hearts and Minds Investments Limited

Reminder: these are simply my general views and should not be taken as investment advice

If you would like to receive these weekly updates direct to your inbox, sign up here.

DISCLAIMER: this communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220) and may contain general information relating to HM1 securities. The general information should not be considered financial advice. HM1 is not licensed to provide financial product advice. The information does not consider the investment objectives, financial situation, or particular needs of any individual. The information is current as at the date of preparation and is subject to change. HM1 does not guarantee repayment of capital or any rate of return on HM1 securities. An investment may achieve a lower-than-expected return and investors risk losing some, or all, of their principal investment. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.