Investors who followed stock tips from fund managers presenting at last year’s local Sohn Hearts & Minds conference would be largely ahead – except for a few notable price drops.

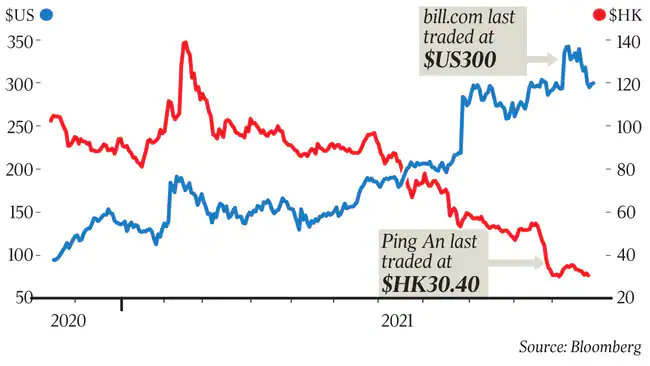

And Cota Capital’s Babak Poushanchi – who in November 2020 tipped New York-listed bill.com – has emerged as the top picker, with the back-office financial management firm’s share price up more than 200 per cent.

The company was one of 10 stocks tipped at the conference alongside Frankfurt-listed global food delivery company HelloFresh, American outfits Slack and Target and Australia’s Treasury Wine Estates.

But there were five disappointments, including two Hong Kong listed stocks – Ping An Health Care and Technology, which has lost 70 per cent of its value over the year, and Chinese mobile payments platform Yeahka, which lost almost 30 per cent, along with US-listed Teladoc Health, which lost more than 40 per cent, phone company T Mobile (down more than 10 per cent) and Nintendo (down 7 per cent).

Investors will be keen to see what Poushanchi tips at this year’s conference. His pick last year, bill.com, a Silicon Valley-based company that automates backoffice management for small and medium-sized business, saw its stock soar over the year, gaining more than 200 per cent to almost $US300 last week.

Tipping the stock last year, Poushanchi said he believed the company, which does business with ASX-listed small business accounting platform Xero, had the potential to grow its revenues from $US200m to $US2bn as the leader in the underpenetrated market with a potential customer base in the US of six million. Its revenue has grown to more than $US300m ($420m) over the year.

The next most successful pick was HelloFresh, chosen by Nick Griffin of Munro Partners.

The share price of HelloFresh, which has operations around the world including Australia, grew by more than 100 per cent over the year. The business has benefited from pandemic lockdowns around the world.

Investors in Slack, tipped by TDM Growth Partners’ Hamish Corlett, would have done well. Shortly after the conference, the company said it had struck a deal to be acquired by Salesforce for $US27.7bn – sending the share price from about $US25 to more than $US45.

Corlett is another returnee for this year’s conference.

Tribeca Investment Partners analyst Jun Bei Liu also got it right last year when she tipped Australia’s largest wine company, Treasury Wine Estates, despite it facing steep tariffs in China, its largest export market.

Jun Bei argued that while TWE’s wine exports from Australia would be affected by the introduction of heavy tariffs in China, the company’s shares were oversold and Treasury Wine Estates was cheap at $9.18.

While the company’s wine sales from Australia to China are still effectively blocked, the company has a global business and is refocusing its exports to China from its operations in the US and Europe. Its share price has recovered to about $12, giving investors who followed her tip a gain of more than 30 per cent.

Fundies who tipped high-profile China-based stocks, however, were blindsided by a government-led crackdown on technology companies.

Prince Street Capital’s David Halpert tipped Ping An Health Care, the Shanghai-based healthcare services unit of insurance giant Ping An Insurance, which was the biggest loser of the year for Sohn Australia followers.

While the company’s revenue has continued to grow, its shares were hit by a combination of its reported losses and the moves by Chinese regulatory authorities.

Tekne Capital’s Beeneet Kothari, who is also back for this year’s conference, saw his 2020 pick, Chinese payments platform Yeahka, hit by the same crackdown on tech companies.

Investors who got out at the right time would have done well. The company’s shares surged by more than 230 per cent in three months after his pick, but have fallen 30 per cent over the year.

The year has not been a good one for ARK Investment’s Cathie Wood, who tipped US online doctor service Teladoc Health.

Wood tipped the company after it had done well in the Covid-19 pandemic with its online healthcare business, as Americans were wary about visiting their doctor in person.

The stock, which was trading at $US183 in November last year, rose after her pick to a record $US293 in February this year.

But the company has lost favour with analysts, with its latest revenue forecasts not as strong as expected, seeing its price down to just over $US100 recently – a loss of more than 40 per cent for investors who stayed with the stock over the year.

Cooper Investors’ Asian equity analyst, Qiao Ma, saw her pick, Shenzhou International, rise by about 19 per cent over the year despite the travails of other Chinese companies and the impact of Covid-19 on supply chains.

In her first appearance at the conference last year, Ma picked Shenzhou, the Hong Kong-listed and China-based company that makes clothing for Nike, Adidas, Uniqlo and Puma.

In a recent interview with The Australian, Ma said she had long-term confidence in the company, which had done well despite supply chain issues, including congestion at the port of Los Angeles and factory shutdowns in Asia.

Ma says Shenzhou’s performance is proof of her argument about the rising quality management of some companies in China. She told The Australian that she intended to tip a Hong Kong-listed consumer brand at this year’s conference.

The Sohn conference started in New York in 1995 to commemorate the life of Ira Sohn, a Wall Street fund manager who died from cancer at the age of 29.

The idea of the conference has spread around the world, with top fund managers tipping stocks to raise money for medical research.

This year’s conference in Australia, its second online as a result of Covid-19, will feature a video appearance by Warren Buffett’s colleague, Charlie Munger.

This article was originally posted by The Australian here.

Licensed by Copyright Agency. You must not copy this work without permission.