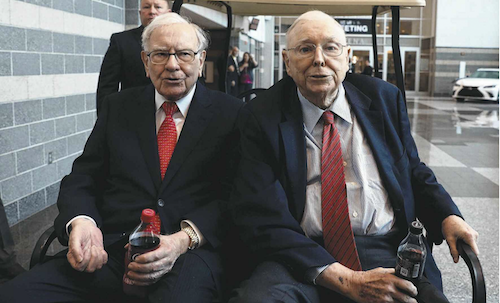

Once a week at either 1am or 3am depending on the time of year, Dr Mark Nelson is on a call with billionaire investor and co-chairman of Berkshire Hathaway, Charlie Munger.

“I'm among a group of friends that meet virtually once a week to chat about events of the day and investment,” he said.

Nelson, chairman and co-founder of Caledonia Investments, has had long history with Los Angeles-based Munger.

It goes back 25 years when he first became fascinated with Munger and his other half, Warren Buffett and joined the Omaha tragics on the pilgrimage to the annual shareholder meetings in Nebraska.

It was through this precious connection that Charlie Munger, now 97, agreed to be headline speaker at this year's Sohn Hearts & Mind conference.

“You can't climb a higher peak than that one” said a delighted Hearts & Minds cofounder Matthew Grounds.

“It took me a while to actually get the courage up to ask him to do this,” said Nelson. “I did eventually and he was all over it.”

A joint interest swung the decision. Nelson started out in medicine and is on the board of Neura.

“I told him it's all about medical research, particularly the neurological side which he is very keen on and he knows my interest too. I said how it goes is I interview you and in the past I have interviewed Howard Marks and he's a big fan of Howard's.”

In a statement, Munger says he has always been a believer in and strong supporter of medical research. “It's one of the best investments we can make in the future, and I'm delighted to participate in such a worthy cause.”

Like Nelson, many of the friends at the weekly LA meeting are in their 50s and 60s. “It's lesson to us all. You've got to have friends of different ages.”

Munger, he says, is as sharp as a tack.

“Someone who doesn't suffer fools gladly, he is the epitome of that. He has a brilliant recall of things that happened years ago, that's pretty important and he loves jokes. I'd sometimes ask him about people from the past - two words: absolute moron!” he laughed.

Munger is most famous for being Warren Buffett's offsider but Nelson says Buffett really credits him for turning around the Oracle of Omaha.

“Buffett was a Benjamin Graham disciple. And Graham, the father of value investing, was really just trying to identify an undervalued asset with the expectation that one day it will get revalued. So that's where Warren started, trying to get a dollar out of 50 cents or as he said a cigar butt you get one last puff out of it before it disappears.

“Charlie's idea was that if you buy businesses that grow, growing the earnings over a long period of time, the compound effect was far better than just the one-off valuation uplift,” he said.

In his interview Nelson is not expecting stock tips but there's no shortage of material.

“I'm certainly going to tease him out on China. He is a bull on China, still is a big investor and got some good thoughts. He is very negative on crypto and hopefully he'll give a couple of one-liners. He's good at that.”

Some of the exploits in Nelson's story were captured in Woodstock for Capitalists, a film by his great mate Ian Darling who was in the next door office at Caledonia (the tidy one). Woodstock captured the cultish adoration of shareholders, probably the largest gathering of private wealth in the world and also had a rare interview with Munger.

“Nellie” went with Darling back to Omaha and also starred in the film. “When we started going it was already a big deal: 4000 shareholders. Now 40,000 go, or did before Covid,” he said.

Mark Nelson had a close connection with American investor, the late Otis Booth, who first introduced him to his friend Munger. In the 60s Munger gave Booth a tip that Buffett was worth following. Forbes later put Booth's investment of $1m at over $1bn.

“On the Friday night before the meeting, Charlie would have a dinner for friends and family, usually about 100 people,” said Nelson. “Through Otis we got invited as well and then in our own right. It's a hot ticket as you can imagine, so I really go for the dinner. I might see a Bill Gates, all sorts of people you wouldn't normally have access to, so you are drinking the Kool-Aid to a certain extent. But it is something that is quite cool.”

In the film, Munger talks to the exceptional loyalties of the Berkshire Hathaway shareholders, many who co-owned shares with managers, investing when everyone was young and obscure. “When you come back to a place like that, you are celebrating old loyalties. And of course the basic idea behind so much of Berkshire. The old fashioned idea that the best way to get loyalty is to deserve loyalty,” said Munger.

Of all the early anecdotes Nelson and Darling tell, the best is a brief moment Nelson had with Munger at a function. “What you've got to know about this market at the moment is three things,” said Munger. He then looked across at someone and walked off, leaving Nelson hanging on an answer. “It was hilarious,” said Nelson. “We've never forgotten.”

This article was originally posted by The Australian here.

Licensed by Copyright Agency. You must not copy this work without permission.