Auscap Asset Management - Tim Carleton

Auscap Asset Management is a value-based Australian equities manager founded in 2012 by Tim Carleton and Matthew Parker. Auscap manages the Auscap Long Short Australian Equities Fund which aims to deliver attractive absolute risk adjusted returns over time through active, disciplined, patient long and short investing. Auscap focuses on identifying high quality businesses that generate strong cash flows and are trading at attractive prices. The investment team has over 60 years of experience in the financial services industry. Auscap’s portfolio managers and staff are substantially invested in the fund.

Recommendation: JB Hi-Fi (JBH AU)

JB Hi-Fi is Australia’s leading consumer electronics and home appliances business, with its two leading retail brands, JB Hi-Fi and The Good Guys, expected to generate over $7bn worth of sales across over 300 stores in 2019. JB Hi-Fi is focused on the value proposition it offers its customers, providing the best range of brands at low prices supported by strong customer service. Through its scale, low cost operating model, quality store locations, strong supplier partnerships and multichannel capabilities the group is well placed to continue to drive growth in revenues and earnings in the years ahead.

What Tim Carleton says about JB Hi-Fi

-

JB Hi-Fi is a high quality business, with strong and consistent returns on invested capital, high cash generation and a sensibly geared balance sheet. Its return on tangible assets has averaged 24% over the last decade.

-

JB Hi-Fi has a strong market position with very competitive prices, an incentivised workforce, great management and a very low cost of doing business.

-

JB Hi-Fi provides investors with exposure to the electronics supercycle, Australia’s growing population and a strong underlying economy.

-

JB Hi-Fi is experiencing strong online sales growth, taking advantage of its quality range, competitive prices, omnichannel offering (where shoppers can purchase online, through click and collect or purchase in store), fast delivery, clever distribution through its store network and professional category focused advice.

-

JB Hi-Fi is priced attractively at 12x current earnings, trading at a material discount to the ASX200. With a significant dividend yield, good anticipated growth in earnings and the potential for a move back towards a market multiple should economic and competition fears subside, there is significant potential upside for investors in owning one of the best retail operators in the country.

| Company information |

|

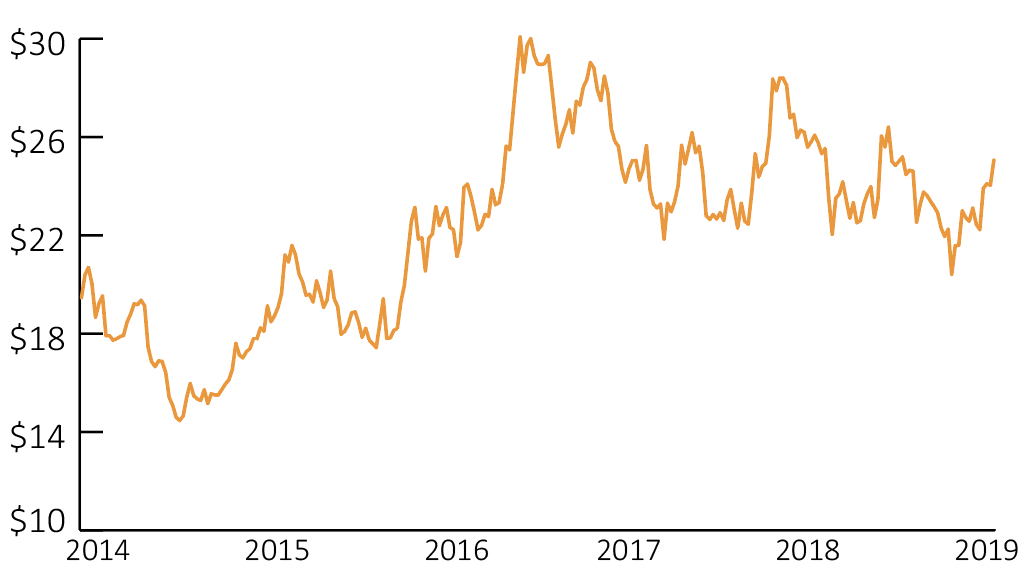

JBH: 5 year share history |

| ASX Code: |

JBH |

| Market Capitalisation: |

$2.9b |

| Volume: |

818,196 |

| 52 week range: |

$20.30 - $26.69 |

| Bloomberg consensus: |

6 Buys, 6 Holds, 3 Sells |

| Price target: |

$24.30

|

|

|

|

Download this manager in focus as a PDF.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.