Cooper Investors - Peter Cooper

Cooper Investors ("CI") is a specialist equities fund manager with funds under management of approximately A$13.5 billion. CI commenced operations in 2001 and manage money for a range of clients including large pension and superannuation funds, religious institutions, Australian State Government agencies, school endowments, charities and high net worth families and retail clients. CI is 100% owned by its employees. Employees are encouraged to invest in the CI trusts. CI manages 7 pooled investment trusts and a number of individual mandates which invest in Australian equities, international securities or a mixture of both.

Recommendation: Liberty SiriusXM (LSXMA:US)

Liberty SiriusXM is a tracking stock that tracks Liberty Media Corporation’s ~70% equity stake in SiriusXM. SiriusXM is a satellite radio operator serving over 34 million subscribers in the US market with upwards of 200 channels of music, talk and sports programming via monthly subscriptions. SiriusXM also recently acquired Pandora, a streaming radio business with almost 65m active users.

What Peter says about Liberty SiriusXM

- Many Australians won’t be familiar with satellite radio provider SiriusXM as they don’t operate here. Satellite radio is a subscription service providing customers with ~200 channels of curated music, talk and sports programming. The product is typically distributed with a vehicle purchase and is imbedded in the dashboard as an additional choice to free AM/FM terrestrial radio. The average US commuter spends 18,000 minutes per annum in their car so it’s a great customer proposition versus terrestrial which typically plays 25 minutes of ads per hour.

- SiriusXM is one of the most profitable media assets in the world with 34m subscribers paying $15 a month for the service. An advantaged cost structure allows SiriusXM to leverage their content costs and generate operating leverage as the company accrues more subscribers. The ability to grow subscribers, revenues and control costs is the hallmark of SiriusXM. The business has built in growth as the service rolls out across the US car fleet and will continue to grow its $1.6bn free cash flow base.

- SiriusXM wasn’t always this profitable and during the financial crisis the company was loss making and on the verge of bankruptcy until billionaire and legendary media investor John Malone came in and wrote a cheque for US$400m in emergency financing for 40% of the company via his Liberty Media holding company. Fast-forward to 2019 and SiriusXM has acquired the streaming radio business Pandora Media, we see a strong resemblance between these two transactions.

- We see several clear opportunities for SiriusXM to generate material free cash flow from the Pandora assets such as cross selling to each other’s subscriber base as well as sharing content and advertising technology. SiriusXM will also bring much needed cost discipline to Pandora. The market is missing these latencies - our valuation of SiriusXM which takes account long term earnings power of SiriusXM and Pandora implies a 40% upside to the current share price.

- The Liberty SiriusXM tracking stock is the vehicle in which Malone owns his stake. It trades at a 30% discount to the net asset value – essentially just the listed SiriusXM shares. Malone’s comments and our analysis suggests this situation is unlikely to persist over the long term and that patient shareholders will get rewarded as Liberty takes action to close the discount. In the meantime we own an attractively priced core SiriusXM business with sustainable growing free cash flow and sizeable upside from driving the Pandora business into profitability.

Liberty SiriusXM: Company Details

| Ticker code |

LSXMA:US |

| Market Capitalisation: |

USD $13.1bn |

| Volume: |

2.6 million |

| 52 week range: |

USD $34.92 - $47.54 |

| Bloomberg consensus: |

8 Buys, 1 Hold, 0 Sells |

| Price target: |

USD $59.40 |

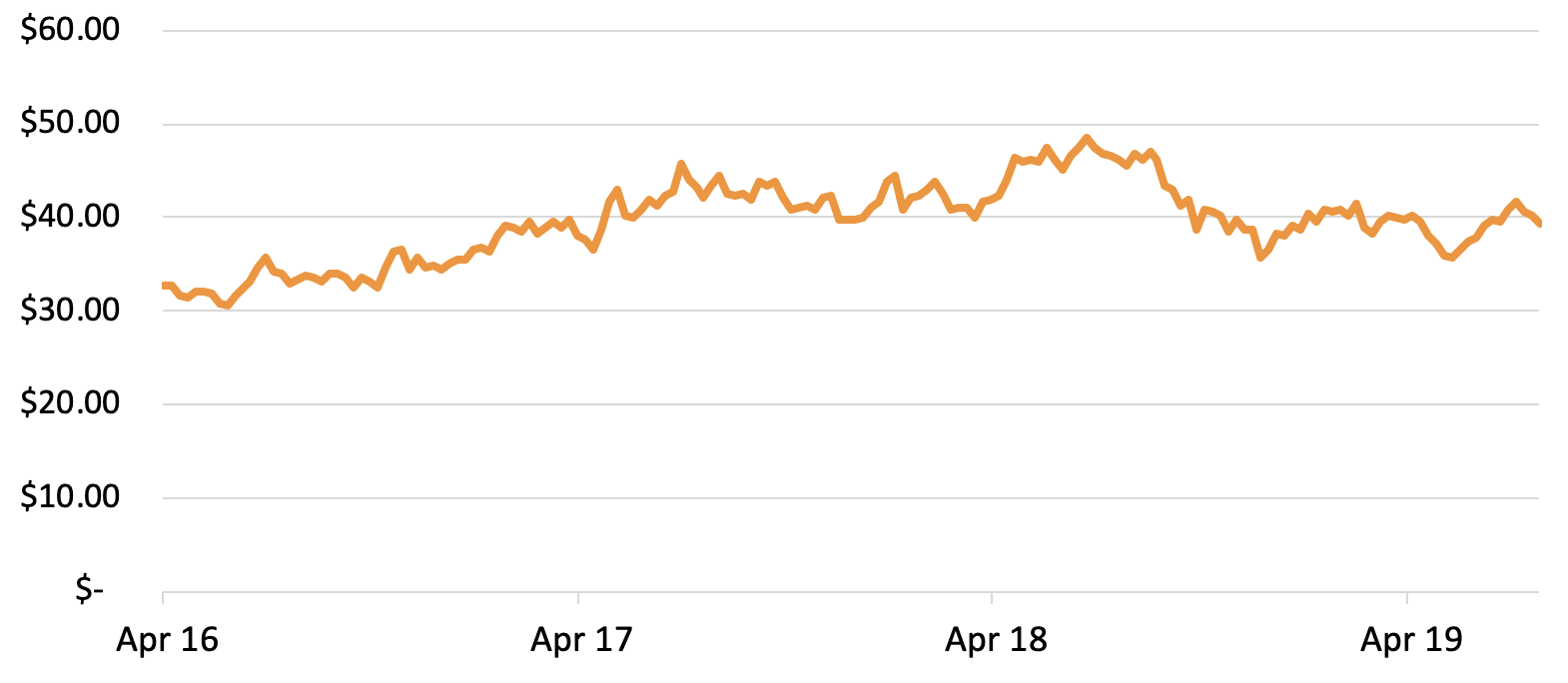

Liberty SiriusXM: Share history

Download this manager in focus as a PDF.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.