Montaka Global Investments – Christopher Demasi

Montaka Global Investments (Montaka) is a global equities fund manager, founded in 2015 by Andrew Macken and Christopher Demasi, which seeks to deliver higher returns with lower risk than the market. Montaka’s long/short strategy invests in a high-conviction long portfolio of high-quality businesses that are materially undervalued and an independent short portfolio of businesses that are structurally challenged, misperceived and overvalued. A long-only version is also offered. Montaka’s founders and team members are the majority-owners of the business and invest substantially all their personal wealth alongside clients. Montaka has offices in Sydney and New York and manages over A$500 million.

Recommendation: Airbus SE (AIR FP)

Airbus is a leading global aerospace company generating almost €70 billion in annual revenue. Airbus Commercial is the crown jewel (75% of total revenues and 90% of profits). It is one of the world’s leading manufacturers of passenger aircraft, including the narrow-body A320, the wide-body A350, and the world’s largest passenger airliner, the A380. Airbus Helicopters is a global leader in civil and military rotorcraft, and Airbus Defence and Space is a leading supplier to militaries and the space industry.

What Christopher says about Airbus

- Airbus is a high-quality business, stemming from its market leading position in the highly attractive industry for passenger aircraft, demonstrated by return on equity above 30%.

- Airbus leads US-based Boeing in a global duopoly for passenger jets, with almost 60% of narrow-body orders (A320) and half of wide-body orders (A350). Airbus’ backlog of 7,000 orders stretches nine years, securing leadership for the foreseeable future.

- The market structure is virtually impervious to disruption. Initial capital outlays of tens of billions of dollars, decade-plus payback periods, and technological expertise and commercial relationships developed over decades are extremely high barriers for potential entrants.

- Airbus will benefit from structural growth tailwinds over the next 20 years, as the global middle-class population increases by two billion people, demand for air travel more than doubles, and airlines purchase over 37,000 planes to expand their fleets.

- Deliveries of Airbus’ key A320 and A350 aircrafts will ramp quickly and grow strongly, more next-gen and long-range variants will be sold for higher prices, and profit margins will ultimately double.

- At the current share price, we think the market is underappreciating this long run growth and profit opportunity. We estimate the stock is worth €150 per share today, or 50% upside, with little downside risk.

| Company information |

|

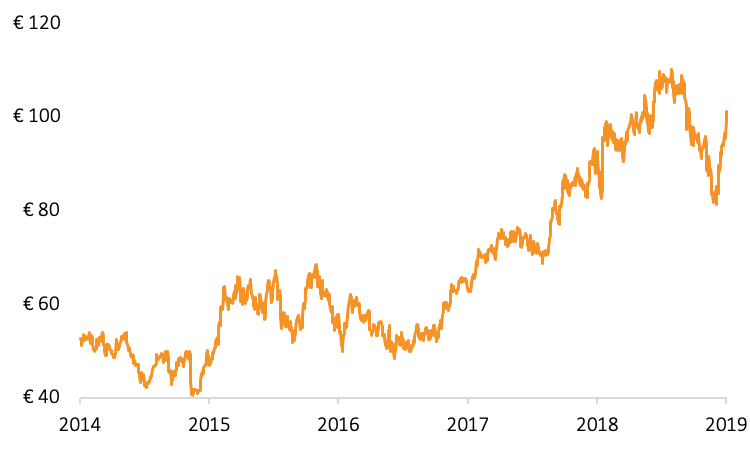

AIR: 5 year share history |

| Ticker code: |

AIR |

| Market Capitalisation: |

€78.5 billion

|

| Average daily volume: |

1.589 million shares

|

| 52 week range: |

€81.21 - €110.06

|

| Bloomberg consensus: |

25 Buys, 5 holds, 0 Sells

|

| Average price target: |

€117.77

|

|

|

|

Download this manager in focus as a PDF.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.