Tekne Capital Management - Beeneet Kothari

Tekne Capital Management, LLC (‘Tekne’) is a fundamental equity manager that focuses on investing in technology, media, digital consumer, payments, and telecommunications businesses globally. Tekne was founded in 2012 by Beeneet Kothari who is its Managing Partner and Principal Portfolio Manager. Tekne manages a concentrated portfolio of global, liquid, publicly-listed securities. The team conducts research and diligence to identify securities which are at a significant discount or premium to their long-term intrinsic business value. The founding partners of the firm have invested substantially all their net worth in the business, thus aligning their interests with that of their investors. The team is based in New York.

Recommendation: PagSeguro Digital Ltd (PAGS:US)

PagSeguro Digital Ltd. provides financial technology solutions and services for micro-merchants and small and medium-sized businesses in Brazil and internationally. The Company offers multiple digital payment solutions, in-person payments via point of sales devices, prepaid cards services, value-add services and online gaming.

What Beeneet Kothari says about PagSeguro

-

PagSeguro is the first-mover and market-leader in the micro-merchant segment. It has >10x the payment volume of its closest competitor. PagSeguro has the highest brand awareness (3x more Google search volume than next biggest player) and has preferential access to advertising in Brazil because it is owned by a large Brazilian media conglomerate.

-

The micro-merchant segment in which Pagseguro operates is less competitive; >80% of its clients never accepted credit/debit cards prior to PagSeguro, and >50% don’t have a bank account. All PagSeguro’s clients are digitally acquired and self-onboard to the platform.

-

The market opportunity is large and unpenetrated; >20 million small/micro-merchants generating >R$5 trillion of volume. PagSeguro today services 4 million merchants doing R$86 billion of volume. Credit/debit cards are only 36% penetrated in Brazil, and less in the micro-merchant segment.

-

In the medium-term, PagSeguro has ancillary market opportunities in consumer banking, credit and merchant software, which combined represent a 14x larger opportunity than payments alone.

-

PagSeguro is growing very quickly and is highly profitable already. In 2018, the company grew payment volumes 98%, service revenues 87% and net income 115% with 39% EBITDA margins.

-

PagSeguro is undervalued and we believe there is upside to consensus estimates. We estimate PagSeguro is trading at <15x future earnings per share after backing out cash on-hand.

-

We believe PagSeguro could be worth $100 per share over a 2-3-year period, which is more than 100% upside.

PagSeguro Digital: Company Details

| Ticker code |

PAGS:US |

| Market Capitalisation: |

USD $15.5bn |

| Volume: |

2.2 million |

| 52 week range: |

USD $17.02 - $48.88 |

| Bloomberg consensus: |

14 Buys, 3 Holds, 1 Sell |

| Price target: |

USD $43.81 |

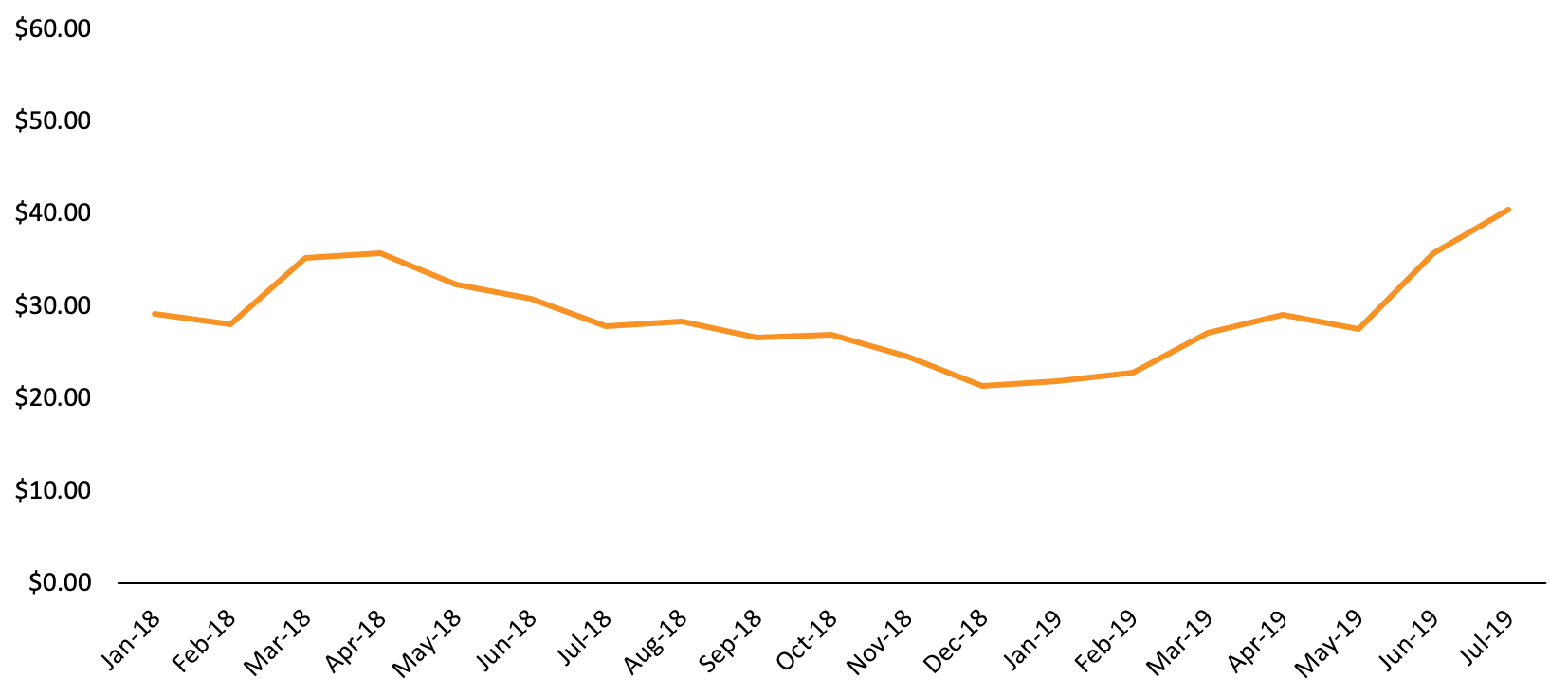

PagSeguro Digital: Share history

Download this manager in focus as a PDF.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.