Tribeca Investment Partners – Jun Bei Liu

Tribeca Investment Partners is a leading boutique fund manager with a twenty year history of creating value for investors through the management of innovative and specialised funds. Headquartered in Sydney with global offices in Singapore and London, Tribeca is wholly owned by its employees and manages $2.4bn across a suite of actively managed traditional long only and alternative investment strategies focused on Australian and global equities and natural resources. Tribeca’s client base includes leading pension, endowment foundations, financial institutions and family offices.

Recommendation: New Oriental Education & Technology (EDU US)

New Oriental is the largest provider of private education services in China with a network of 88 schools and 1,100 learnings centres across 76 cities. New Oriental generates the majority of its earnings from After School Tutoring services for K-12 students and a small contribution from adult test preparation for overseas and domestic exams. The company has been listed on the NYSE since 2006.

What Jun Bei says about New Oriental

- New Oriental is a high quality business that operates in an attractive industry underpinned by strong structural growth drivers.

- Spending on private education in China is growing exponentially and we expect it to increase by almost 3 fold by 2030 to US$692b. The After School Tutoring market currently accounts for 37% of the total private education spend and is expected to reach 80% with the rise of Chinese middle-class income.

- Being one of the first entrants in the After School Tutoring market allows New Oriental to build scale and reinvest in staff, curriculum as well as a technology platform.

- New Oriental has been growing at a compounded rate of 20% since listing and we are expecting it to grow between 20-30% over the next 10 years.

- Recent government regulatory reforms to improve teaching standards favour incumbent players such as New Oriental and it is well positioned to take advantage of consolidation opportunities with more than US$1b in net cash.

- New Oriental is attractively priced relative to its peer group and our target price is US$90.30.

| Company information |

|

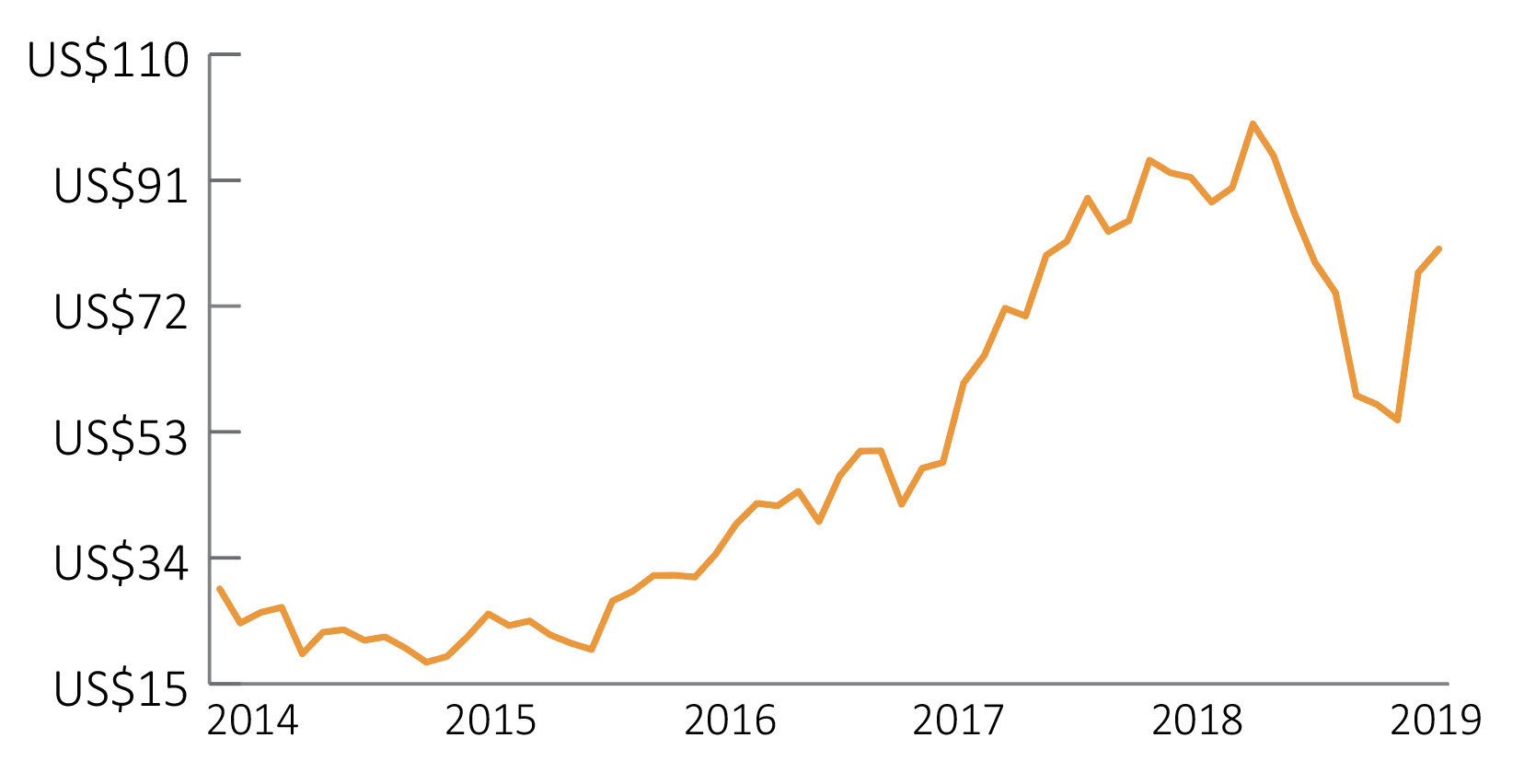

EDU: 5 year share history |

| ASX Code: |

EDU |

| Market Capitalisation: |

US $12.7b |

| Volume: |

US $120m |

| 52 week range: |

US $50.80 - $108.24 |

| Bloomberg consensus: |

26 Buys, 5 Holds, 0 Sells |

| Price target: |

US $90.30

|

|

|

|

Download this manager in focus as a PDF.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.