Wilson Asset Management - Geoff Wilson AO

Wilson Asset Management has a strong track record of delivering risk-adjusted returns for shareholders and making a difference for investors and the community for more than 20 years.

Established in 1997 by Geoff Wilson AO, Wilson Asset Management is responsible for investing more than $3 billion in undervalued Australian and international growth companies on behalf of 80,000 retail investors across six listed investment companies (LICs).

Wilson Asset Management created, and is the lead supporter of, the first LICs to deliver investment and social returns: Future Generation Investment Company (ASX: FGX) and Future Generation Global Investment Company Limited (ASX: FGG).

Wilson Asset Management advocates and acts for retail investors, is a member of the global philanthropic Pledge 1% movement and provides all team members with $10,000 each year to donate to charities of their choice.

Recommendation: Bandai Namco Holdings (7832 JP)

Bandai Namco is a Japanese-listed company specialising in gaming, entertainment and toy manufacturing. Formed from the merger of Bandai and Namco in 2005, it is the owner of a large catalogue of intellectual property and is exposed to future revenue opportunities through the growth of the mobile and Chinese gaming industries.

What Geoff Wilson says about Bandai Namco

- Bandai Namco generates the majority of its profits from the steadily growing $100bn+ global video gaming market. We believe the global video gaming market is in the early days of a long growth story, given demographic shifts whereby younger customers are more inclined towards computer gaming as a form of entertainment, and because of the per-hour cost difference between video gaming (c. $1-$2 per hour) and other forms of entertainment such as movies or sporting events.

- China is a market dominated by mobile gaming and Bandai Namco is currently notably underpenetrated. China is the world’s largest video gaming market, yet even off this large base it is growing at double digit rates annually. To win in China, outside firms team up their intellectual property with local distributors like Tencent. Again, Bandai Namco is well positioned with strong internal intellectual property in names such as Dragon Ball, Pacman and Gundam ready to leverage into the Chinese market.

- From a risk-management perspective, the company runs a conservative, strongly net-cash balance sheet which will serve to cushion the stock price should turbulence in global markets continue.

- The company is trading at a very reasonable 8x earnings before interest, tax, depreciation and amortisation (EBITDA), which compares favourably to other firms in the video gaming industry including EA (13x), ActivisionBlizzard (14x), and Take-Two (17x). We see catalysts ahead to drive the share price higher as the company continues to deliver positive earnings surprises and its valuation moves closer its global peers.

| Company information |

|

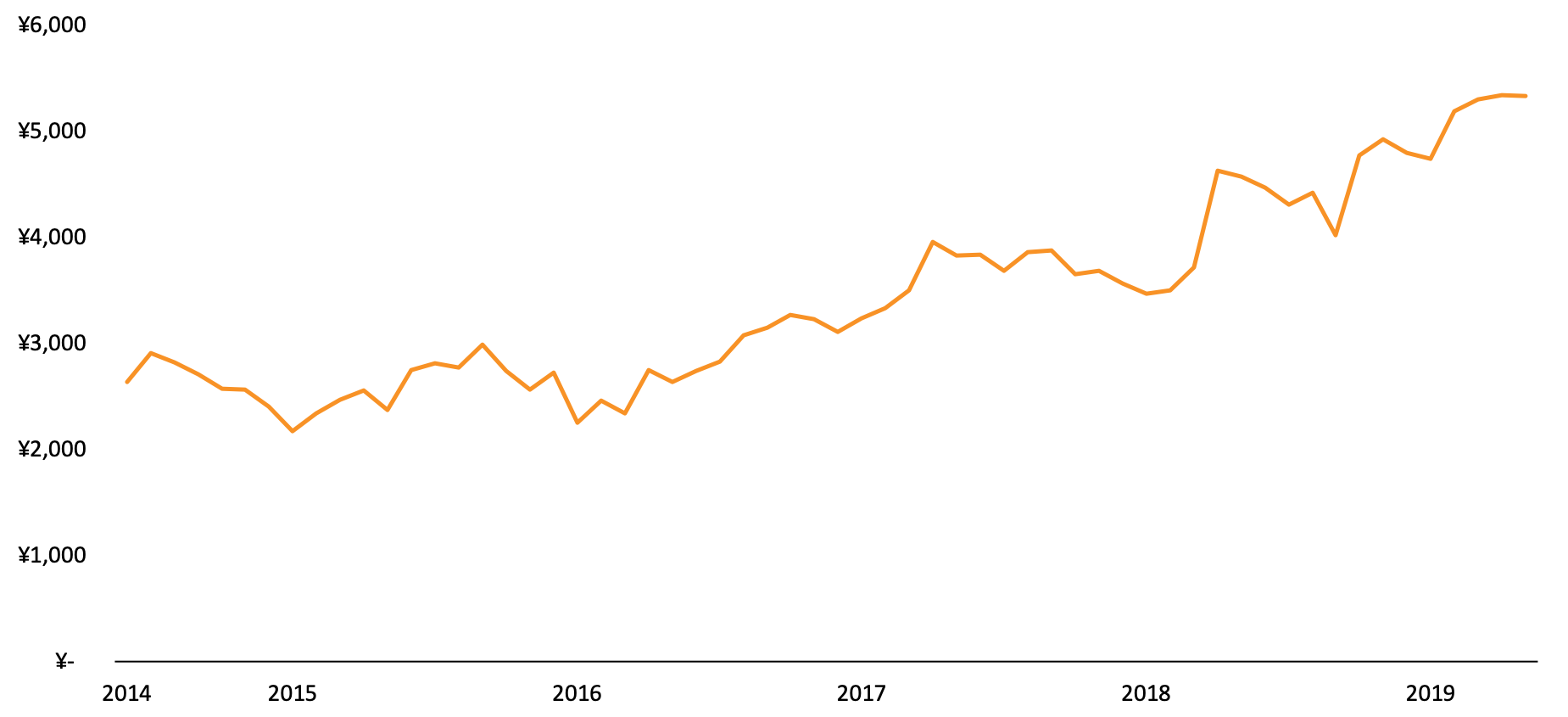

Bandai Namco: 5 year share history |

| ASX Code: |

7832:JP |

| Market Capitalisation: |

¥ 1.15bn

|

| Volume: |

715,000

|

| 52 week range: |

¥ 5,570 - ¥ 3,825

|

| Bloomberg consensus: |

9 Buys, 5 holds, 0 Sells

|

| Price target: |

¥ 6,055

|

|

|

|

Download this manager in focus as a PDF.

DISCLAIMER: This communication has been prepared by Hearts and Minds Investments Limited (ABN 61 628 753 220). In preparing this document the investment objectives, financial situation or particular needs of an individual have not been considered. You should not rely on the opinions, advice, recommendations and other information contained in this publication alone. This publication has been prepared to provide you with general information only. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Past performance is not a reliable indicator of future performance. This document may not be reproduced or copies circulated without prior authority from Hearts and Minds Investments Limited.