Rory Lucas may have one of the best jobs in finance. As the chief investment officer of Hearts & Minds Investments (HM1), it's his duty to oversee the $780 million portfolio of the best ideas from some of the world's top investors.

"These guys are next-level intelligence on their stocks," Mr Lucas told The Australian Financial Review.

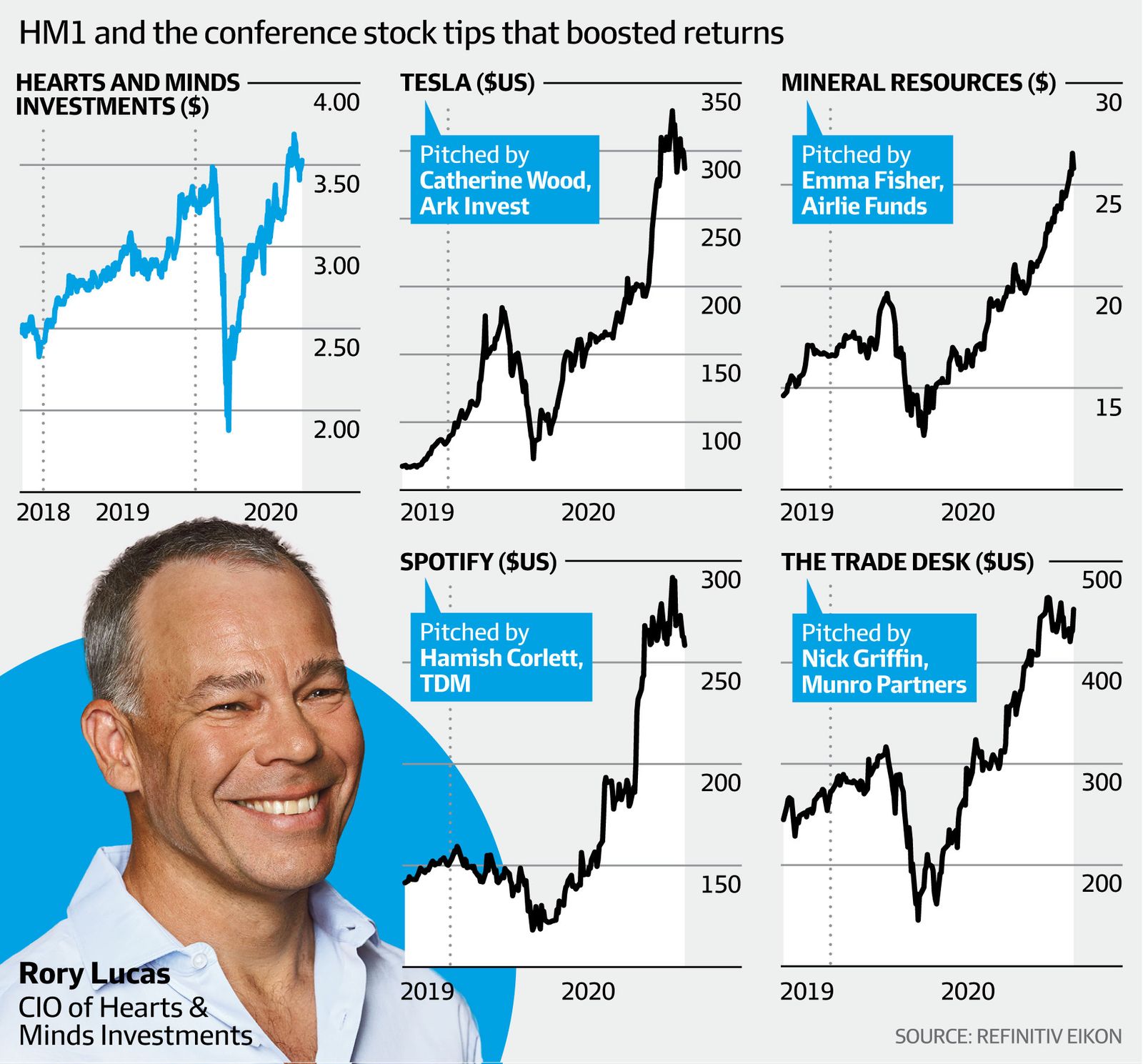

Rory Lucas, chief investment officer of HM1, has overseen a strong performance for the LIC.

"They really are the best of the best. Having worked on an equities desk and listened to people pitch stocks to clients, these fund managers are smarter than I ever gave them credit for."

The Sohn Hearts and Minds LIC was set up in 2018 and invests in the stocks tipped by fund managers at the prestigious annual conference. That is in addition to a portfolio of three undisclosed picks from a group of core managers – Caledonia, Regal, TDM, Magellan, Cooper Investors and Paradice.

The picks and the performance have been nothing short of stellar. The hottest idea was from the self-proclaimed most trolled fund manager in the world, Catherine Wood of Ark Invest, who backed Tesla to a 6.5 times gain.

"She stood firm. She had sound reasons and the interaction with her was more than anyone else because it was such a volatile stock," said Mr Lucas.

Tesla's 650 per cent return is one of four stocks that doubled to August 31. Others are Emma Fisher of Airlie's Mineral Resources tip, Hamish Corlett of TDM's Spotify call and Nick Griffin's recommendation to buy The Trade Desk.

The constant interaction with fund managers is a key part of Mr Lucas' role in managing the portfolio as he frequently checks to gauge whether the tipsters still believe in the stock as the environment or the stock price changes.

That was the case when the COVID-19 pandemic forced a near shutdown of the global economy. Some managers, Mr Lucas said, told him their thesis needed to be torn up.

In some cases, they recommended taking advantage. That was the case for Markus Bihler of Builders Union, who had pitched London-listed Wizz Air, a Hungarian-based low cost airline.

"He was really open about it – that they won't be flying much but their balance sheet is so strong we think they will be okay."

The stock, Mr Bihler told Mr Lucas, was oversold and if the fund has some cash available, they should buy.

"That was a fantastic example of a manager that had done all the work behind the stock. His conviction never wavered."

Going virtual

Mr Lucas says it's the conviction of the fund managers like Woods and Caledonia in the face of extreme uncertainty which has stood the portfolio in good stead.

While the broader global equity market is flat over six months, HM1 has delivered an investment return of 23.9 per cent. Since its inception, the fund has clocked a post-tax performance just shy of 40 per cent, four times the total return from the Australian share index.

Impressively for the embattled LIC sector, the share price has broadly tracked the NTA.

That's great news for the medical research charities that receive semi-annual distributions equal to 1.5 per cent of the net asset value.

Over the six months, that summed to over $5 million and the annual distribution is on track to exceed $10 million.

While the pandemic has turbo-charged the technology heavy fund's performance, it has disrupted the event.

The Sohn Hearts & Minds event was scheduled to take place in Tasmania at the end of the year. But COVID-19 has left the organisers little choice but to go virtual. SohnX Australia will be held on November 13.

Of course with more than just reputations but millions of dollars on the line, the speaker list takes on a whole new degree of importance.

Mr Lucas says the team is in the process of selecting the manager roster as they try to assemble a mix of returning managers and new blood, in addition to managers with different niches.

Such is the demand to present at the conference, Mr Lucas says they have had to turn some speakers away.

And given Mr Lucas will have the task of owning and managing the stocks that are presented, he will be the keenest of observers.

He's given no heads up as to what shares the conference managers will be tipping, but once it's known, he and the investment committee will have to assess the liquidity in the company before deciding how much to buy.

"I want to sit in the conference with everyone else and hear what the stocks are," he said.

A link to the Sohn Hearts & Minds 2020 Investment Leaders conference website can be found here.

This article was originally posted on The Australian Financial Review here.

Licensed by Copyright Agency. You must not copy this work without permission.